Hiring an Olympia WA Estate Planning Lawyer streamlines probate, saves time, and protects privacy. They create personalized plans (wills, trusts) for asset distribution according to your wishes, minimizing legal fees and stress for loved ones. Regular reviews ensure adaptability in changing circumstances.

In Olympia, WA, understanding probate is crucial for effective estate planning. This process can be complex and time-consuming, but with personalized strategies, you can minimize its impact. Our article guides you through key aspects of estate planning, including benefits of tailored plans, creating a will to avoid probate, incorporating trusts for asset protection, selecting the right executor, and regular reviews. Discover how an Olympia WA Estate Planning Lawyer can help navigate these steps smoothly.

- Understanding Probate in Olympia, WA

- Benefits of Personalized Estate Planning

- Creating a Will to Avoid Probate

- Incorporating Trusts for Asset Protection

- Choosing the Right Executor

- Regular Reviews: Adapting Your Plan

Understanding Probate in Olympia, WA

In Olympia, WA, probate is a legal process that facilitates the distribution of a deceased person’s assets according to their will or the laws of intestate succession. This process can be complex and time-consuming, often involving court proceedings and the appointment of a personal representative (often a family member or trusted friend) to manage the estate. The primary goal of probate is to ensure that debts are paid and assets are properly transferred to beneficiaries.

Hiring an Olympia WA Estate Planning Lawyer is crucial for navigating this process efficiently and minimizing potential complications. Legal professionals experienced in estate planning can help clients create comprehensive plans, including trusts, wills, and power of attorney documents, designed to avoid probate altogether or streamline it when necessary. This proactive approach not only saves time but also helps protect the privacy and integrity of the estate.

Benefits of Personalized Estate Planning

Personalized estate planning offers a multitude of benefits, especially for individuals seeking to minimize probate in Olympia, WA. By proactively designing a tailored strategy with an experienced Olympia WA Estate Planning Lawyer, you can ensure that your assets are distributed according to your wishes while streamlining the legal process. This proactive approach not only saves time and reduces potential legal fees but also provides peace of mind, knowing your loved ones will be taken care of as you intended.

Additionally, a well-crafted estate plan allows for greater control over your assets, including the appointment of guardians for minor children and the establishment of trusts to manage property for beneficiaries with special needs. This level of customization ensures that your financial future and that of your family is secured in a manner that aligns perfectly with your unique circumstances and goals.

Creating a Will to Avoid Probate

Creating a Will is one of the most effective ways to avoid probate in Olympia, WA. A Will allows you to designate who will receive your assets and responsibilities after your passing, ensuring that your wishes are respected. By having a valid Will, you can bypass the often lengthy and costly process of probate, which involves a court-appointed executor distributing your estate according to legal standards. This means your loved ones can avoid the stress and expense associated with probate, expediting the process of asset distribution.

When you consult with an Olympia WA Estate Planning Lawyer, they can help you draft a comprehensive Will tailored to your specific needs. A well-prepared Will not only minimizes probate but also allows for greater control over how your assets are managed and distributed, ensuring that your estate is handled according to your wishes.

Incorporating Trusts for Asset Protection

Incorporating trusts is a strategic move for those seeking comprehensive estate planning in Olympia, WA. Trusts offer a powerful tool to protect assets and streamline the probate process. By setting up a trust, individuals can transfer ownership of their property, investments, or other valuable possessions into the trust during their lifetime. This ensures that these assets are managed according to the grantor’s specific instructions after their passing, bypassing the time-consuming and potentially costly probate court proceedings.

For Olympia WA estate planning lawyers, trusts provide a tailored solution for clients aiming to maintain control over their affairs while minimizing legal complications. With careful trust creation and management, individuals can protect their assets from potential creditors, ensure privacy, and pass on their legacy according to their wishes. This proactive approach to estate planning is particularly beneficial for those with substantial wealth or complex financial portfolios.

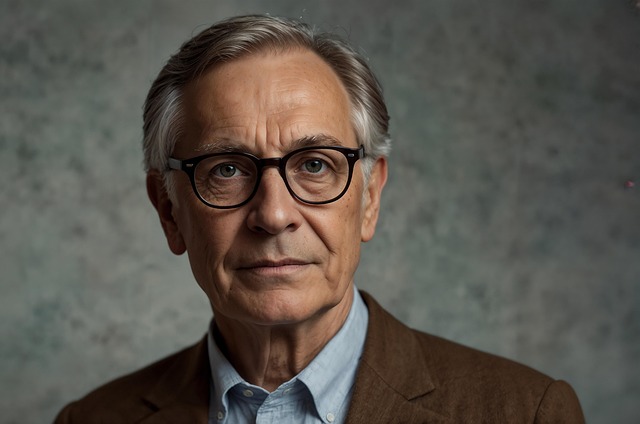

Choosing the Right Executor

When crafting a personalized estate plan in Olympia, WA, selecting the right executor is a crucial step. The executor, or personal representative, acts as the primary administrator of your estate upon your passing. Their role involves overseeing the distribution of assets, paying debts and taxes, and ensuring all legal formalities are met. It’s essential to choose someone trustworthy, organized, and knowledgeable about estate administration procedures, especially when dealing with sensitive financial matters.

An Olympia WA Estate Planning Lawyer can guide you in making this decision, as they understand the local legal framework and can provide insights into the qualifications and responsibilities of an executor. They can also assist in drafting clear instructions to ensure a smooth transition during what can be a challenging time for your loved ones.

Regular Reviews: Adapting Your Plan

Regular reviews are essential components of any well-crafted estate plan, especially in dynamic places like Olympia, WA. Life is unpredictable, and your financial and personal circumstances can change significantly over time. An Olympia WA Estate Planning Lawyer can help you schedule periodic check-ins to reassess your goals, update beneficiary designations, and ensure that your plan remains current and effective. These reviews allow for adaptability, enabling you to incorporate life events like marriages, births, divorces, or career shifts into your strategy.

By staying proactive through regular reviews, you can minimize the risk of your estate plan becoming outdated or irrelevant. This proactive approach ensures that your wishes are accurately reflected in your documents, giving you peace of mind and control over how your assets are distributed after your passing.

When it comes to minimizing probate in Olympia, WA, personalized estate planning is key. By understanding the intricacies of local laws and leveraging tools like wills and trusts, residents can protect their assets and streamline the process for their loved ones. An experienced Olympia WA estate planning lawyer can guide you through each step, ensuring your plan is tailored to your unique needs and goals. Regular reviews are essential to adapt to life’s changes, ensuring your estate remains in good hands.